客戶(hù)案例

-

行業(yè):咖啡館�,山莊����、酒店、民宿

公司:森合?集裝箱有限公司

產(chǎn)品:定制集裝箱商鋪

行業(yè):咖啡館�,山莊����、酒店、民宿

公司:森合?集裝箱有限公司

產(chǎn)品:定制集裝箱商鋪

-

行業(yè):?jiǎn)挝慌c小區(qū)

公司:森合?集裝箱有限公司

產(chǎn)品:定制集裝箱房

行業(yè):?jiǎn)挝慌c小區(qū)

公司:森合?集裝箱有限公司

產(chǎn)品:定制集裝箱房

-

行業(yè):門(mén)店廠(chǎng)家

公司:森合?集裝箱有限公司

產(chǎn)品:定制集裝房門(mén)面

行業(yè):門(mén)店廠(chǎng)家

公司:森合?集裝箱有限公司

產(chǎn)品:定制集裝房門(mén)面

-

行業(yè):交通規(guī)劃建設(shè)

公司:森合?集裝箱有限公司

產(chǎn)品:工地集裝箱房

行業(yè):交通規(guī)劃建設(shè)

公司:森合?集裝箱有限公司

產(chǎn)品:工地集裝箱房

-

行業(yè):山莊���、酒店���、民宿

公司:森合?集裝箱有限公司

產(chǎn)品:定制集裝箱商鋪

行業(yè):山莊���、酒店���、民宿

公司:森合?集裝箱有限公司

產(chǎn)品:定制集裝箱商鋪

-

行業(yè):廣場(chǎng)地面商城、街區(qū)商鋪��、園林內(nèi)商鋪

公司:森合?集裝箱有限公司

產(chǎn)品:集裝箱房商業(yè)街鋪

行業(yè):廣場(chǎng)地面商城、街區(qū)商鋪��、園林內(nèi)商鋪

公司:森合?集裝箱有限公司

產(chǎn)品:集裝箱房商業(yè)街鋪

-

行業(yè):山莊�、酒店、民宿

公司:森合?集裝箱有限公司

產(chǎn)品:定制太空艙

行業(yè):山莊�、酒店、民宿

公司:森合?集裝箱有限公司

產(chǎn)品:定制太空艙

-

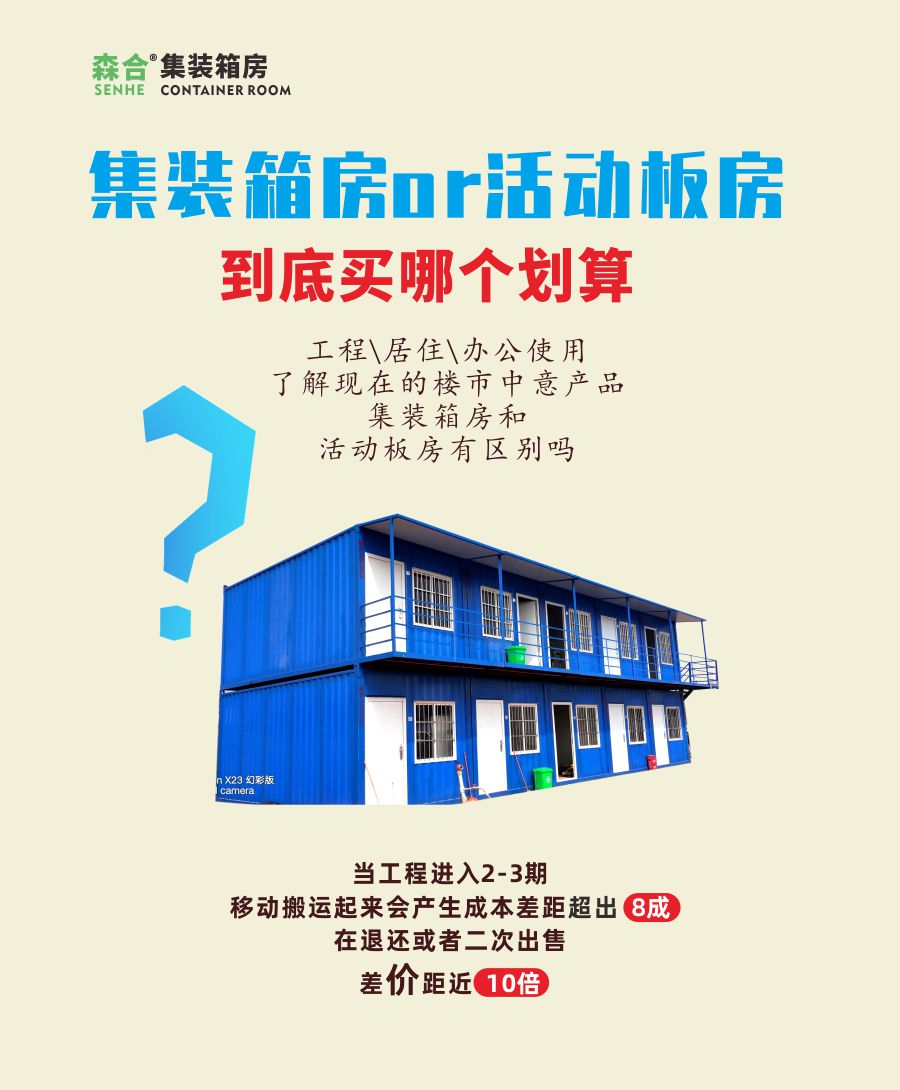

行業(yè):交通規(guī)劃建設(shè)

公司:森合?集裝箱有限公司

產(chǎn)品:聯(lián)排拼接集裝箱房

行業(yè):交通規(guī)劃建設(shè)

公司:森合?集裝箱有限公司

產(chǎn)品:聯(lián)排拼接集裝箱房

-

行業(yè):酒店

公司:森合?集裝箱有限公司

產(chǎn)品:定制集裝箱房

行業(yè):酒店

公司:森合?集裝箱有限公司

產(chǎn)品:定制集裝箱房

-

行業(yè):山莊

公司:森合?集裝箱有限公司

產(chǎn)品:活動(dòng)板房購(gòu)置與租賃

行業(yè):山莊

公司:森合?集裝箱有限公司

產(chǎn)品:活動(dòng)板房購(gòu)置與租賃

公司新聞

-

-